Money Talks: 5 Rules in Personal Finance for a Better 2022

Is financial wellness on your 2022 resolutions list? As with every new year, we hope to do better financially; in savings or in knowledge. To ensure 2022 is the year, we dug deep and put together 5 rules to properly build our personal finances.

1. Block out the noise and focus on yourself

Your personal finances are just that, personal. Sometimes we can lose sight of what our goals are and either consciously or unconsciously compare our finances to our peers. This is especially prominent in the era of social media, where everyone is living what we perceive to be their best life.

Here’s a simple 3-step method to block out social noise:

- Figure out your personal financial goals. Spend a day assessing where you are now and where you want to be. Assign actual figures to your goals and list the actionable steps you will take to achieve it.

- Keep your circle positive. When it comes to social interactions, prioritize quality over quantity. If you find that certain people drain you or continuously put you in a negative headspace, don’t feel guilty for tapering off the relationship.

- Declutter your social media. Remove anyone who triggers you, upsets you or makes you think you’re not where you should be. This means unfollowing your favorite influencers, muting your friends’ stories and limiting other sources of ‘noise’.

2. Create actionable steps that are small and realistic

The awareness of manifestations, vision boards and positive affirmations are in absolute abundance right now. Do they work? Possibly. But manifesting and visualising your success alone isn’t enough; goals are achieved with action. So pair your dreams with actions and keep them small and realistic to help you stay consistent. The problem with big actions is that it’s hard to stay consistent and easier to give up on.

For example, instead of saying this: “I will cut my grocery budget by 50% in 2022”

Try this: “I will opt for cheaper brands to reduce my grocery budget by RM30 every month”

3. Understand your money mindset, then improve it

Your money mindset is what determines how you view, handle and utilize money. For many of us who don’t pay attention to our thoughts and feelings, our money mindset exists within our subconscious and continues to shape the way we perceive our finances. We say, it’s time to take control of this.

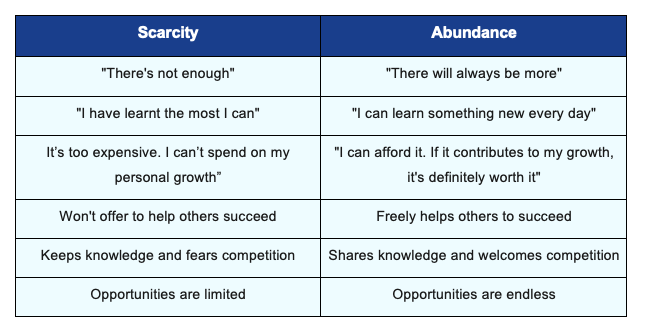

Why is this important? If your money mindset is scarce; with a limiting belief system, it will prevent you from reaching your goals by convincing yourself you can’t achieve more, you don’t deserve it, or there’s not enough to go around.

By taking the time to identify your money mindset, where it came from, and what you want it to be, you will be able to change it to serve your financial goals. One of the many ways to do this is to imagine this mindset to be a scale, measuring between Scarcity and Abundance. Where are you on this scale and how do you get closer towards Abundance?

4. Build a sinking fund & emergency fund

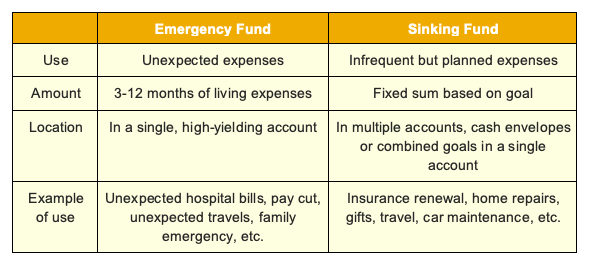

To achieve your financial goals, you need to have budgets for everything. This means having a plan for unexpected expenses and a fund for occasional, expected costs.

An emergency fund will save you when unexpected things happen; such as a paycut, a surprise opportunity to travel, or a family emergency. Whereas a sinking fund ensures you’re covered for necessary but infrequent expenses such as planned travel experiences, a wedding, road tax renewal and other expenses.

So, how do build these funds?

A popular method is to have a detailed budget plan and move your finances as soon as you get your paycheck. A more efficient method would be to use banking automation features to transfer a percentage of your income to each account on your payday. By automating your savings, growing these accounts would be effortless and when things get busy, there’s no chance of missing a month.

To further prepare for unexpected expenses, have rudimentary plans in place for the various aspects of your life. The most essential plan to have is an insurance or takaful medical plan to cushion your finances in the event of a medical emergency.

By doing this, you’re able to budget for the monthly fees of your medical plan; this takes away the need to fork out a lump sum when an unexpected emergency arises. Trust us, hospital bills are hefty!

5. Give generously

As the saying goes, what goes around, comes around. While focusing on building your personal wealth, always remember to give back in whatever way suits you best. Giving doesn’t always have to mean donating large sums of money, it can be in any form that helps another person. Here’s a short list of some ways to give back to your community. What are some other ideas you can think of?

- Donate to a cause, charity or NGO you feel strongly about

- Support fundraisers for causes you believe in

- Buy a meal for friends and family

- Volunteer your time at an animal shelter, soup kitchen, orphanage or any other place that will fill your heart

With these 5 rules in mind, take action and make your financial dreams a reality. If you found this article helpful, don’t forget to share it with your friends and family. After all, sharing knowledge is a trait of an abundant mindset!

The information contained in this blog is provided for informational purposes only, and should not be construed as advice on any matter. Etiqa accepts no responsibility for loss which may arise from reliance on information contained in the article. This information is correct as of 24 January 2022.