Insurance 101: Agreed Value vs Market Value

When it comes to car insurance or takaful, you’re likely to see terms like ‘agreed value’ and ‘market value’. Understanding the difference will help you make informed decisions about the type of insurance or takaful plan you’d like to have and how to ensure you’re getting the most value out of your plan.

Market Value

True to its name, market value is the value of your car according to the vehicle market at the current time. The factors involved in determining its value includes the brand, model and manufacturing year.

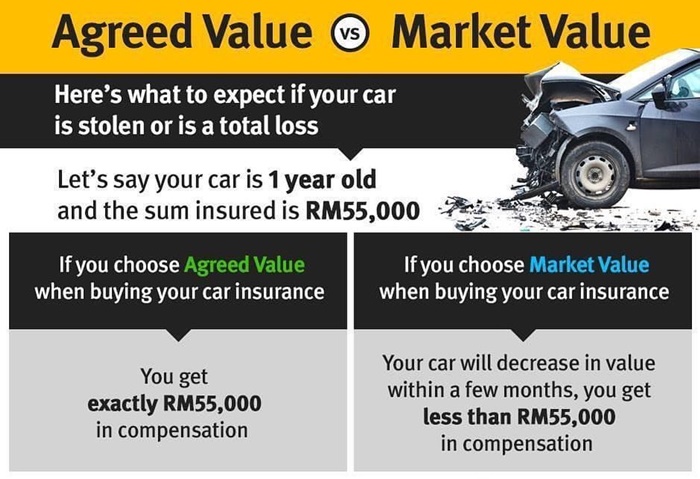

For example, if you insure or cover your car for RM55,000 in January 2021 based on the market value at that time and make a claim for total loss in November 2021, your payout will be less than RM55,000 as your car is likely to have depreciated in value over time. The payable amount will be based on what your car is worth at the time of claim in November 2021.

Agreed Value

An agreed value is a total sum that is agreed between you and your insurance company or takaful provider. This sum will not change even if the value of your car has depreciated.

To exemplify an agreed value condition, if your coverage is agreed for the sum of RM55,000 in January 2021 and you make a claim for total loss in November 2021, you will receive a payout of RM55,000. This doesn’t change even if your car is worth less at the time of claim.

Which Do I Choose?

Both ‘market value’ and ‘agreed value’ have their own pros and cons, neither option is better than the other, they’re just different. As everyone has different requirements and commitments, choosing the type of value would differ from person to person. Based on our existing pool of customers, a majority of users choose ‘agreed value’ as they will receive a better payout sum even though it incurs a slightly higher premium.

If you cannot decide which you would prefer, trust that your insurance company or takaful provider will be able to provide you with the plan suited to your needs.

It’s renewal season so if you’ve yet to get your plan sorted, hop on to Etiqa’s website to get an instant quote with options for market value and agreed value. Did you know you can put in a renewal application up to 2 months before your coverage expires? We love this option as it prevents last minute applications and helps us clear one thing off our to-do list!

The information contained in this blog is provided for informational purposes only and should not be construed as advice on any matter. Etiqa accepts no responsibility for loss which may arise from reliance on information contained in the article. This information is correct as of 26 April 2021.