Surplus Sharing in Takaful: When There’s Extra, You Get a Share

Takaful helps protect what matters to you, like your car, motorcycle, home, or even travel, by providing financial support in times of need. The word takaful comes from Arabic, meaning “joint guarantee,” which reflects the idea of people helping one another and sharing responsibility.

Rooted in the principles of tabarru’ (donation) and ta’awun (mutual cooperation), each takaful participant contributes a sum of money as a donation to a common fund, known as the takaful fund. This fund is used to provide financial assistance to the participants or their beneficiaries when they experience specific losses or damages, such as a car accident or vehicle theft.

But what happens if everything goes smoothly and you don’t make any claims throughout your coverage period? You might be pleasantly surprised to learn that with takaful, you could receive something back through surplus sharing.

Read More: Takaful vs Insurance. What’s the Difference?

What is surplus sharing in takaful?

A unique feature of takaful, surplus is the extra amount left in the takaful fund after accounting for expenses such as total claims and investment profits. A surplus happens when the fund performs better than expected, specifically when underwriting, investments, and expense management yield positive results. This surplus is then shared between the takaful operator and participants at the end of the takaful certificate period, based on a pre-agreed sharing ratio.

As a takaful participant, you may be eligible for a share of the surplus if:

- Your takaful certificate is active for at least one year,

- Your certificate is fully paid within the coverage period,

- Your certificate remains active throughout the coverage period, and

- You did not make any claims during the coverage period (except for windscreen, Knock-for-Knock (KFK), or accessories claims).

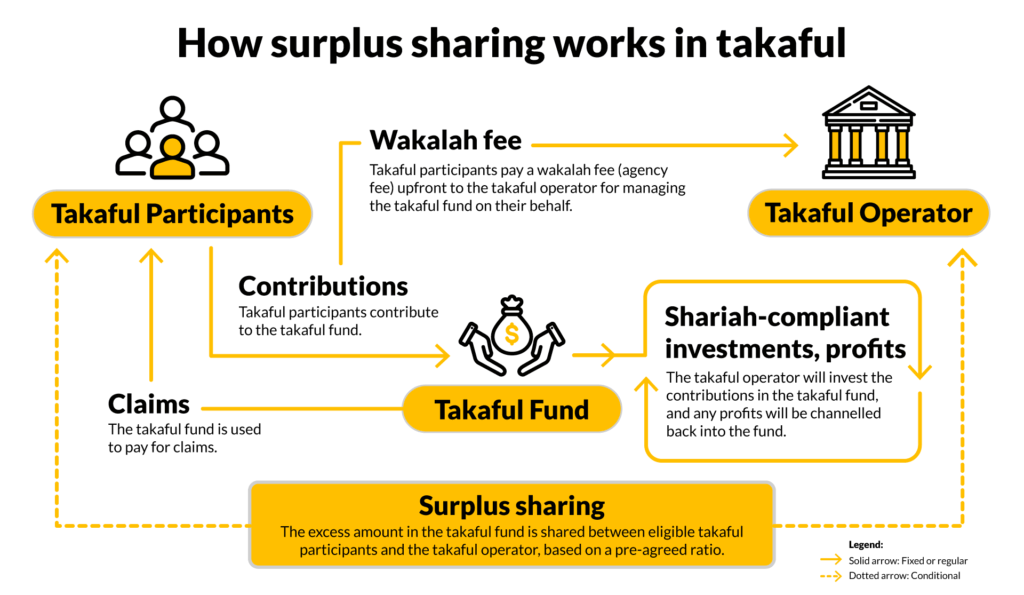

How does surplus sharing work?

Let’s look at how surplus sharing works, based on the relationship between the takaful participant, the takaful operator, and the takaful fund:

How is surplus sharing calculated?

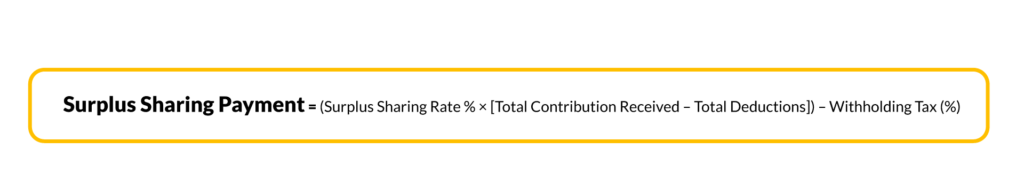

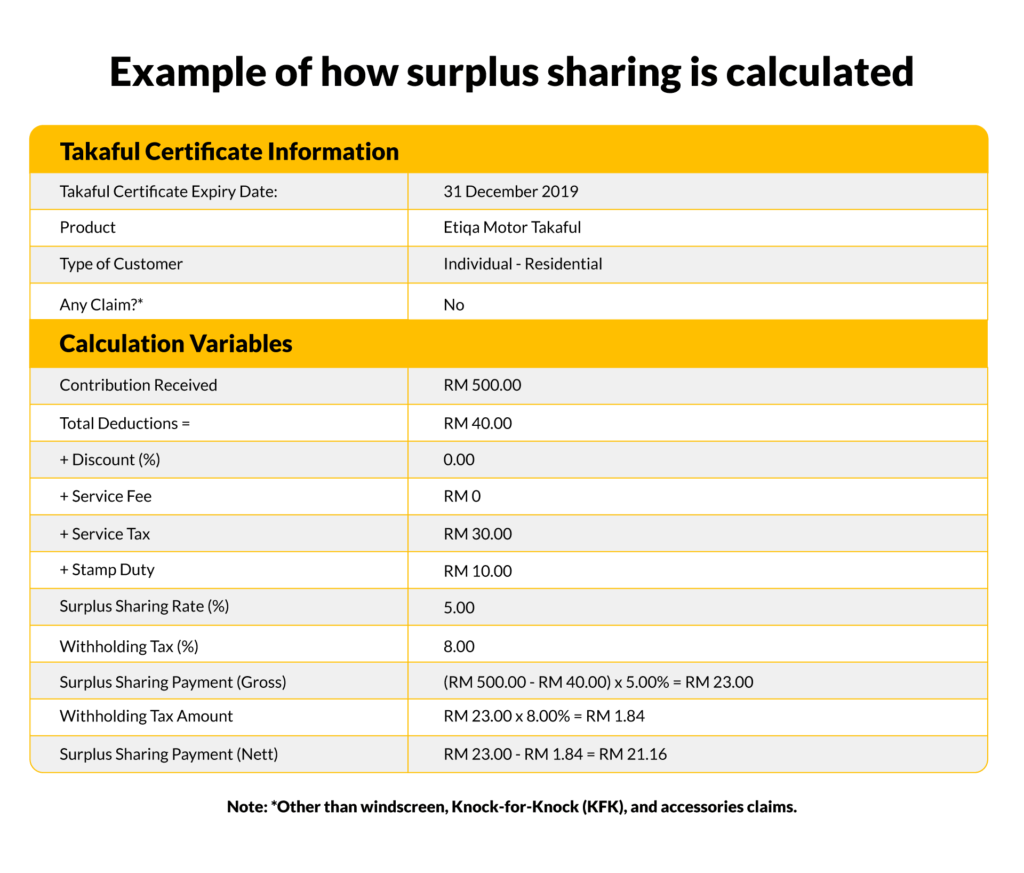

Surplus sharing payment is calculated based on the surplus sharing rate declared by the takaful operator for the given financial year. This rate is applied to the total contribution received after deducting the following:

- Discount (%)

- Service fee

- Service tax (SST)

- Stamp duty

- Retakaful outwards (amount paid to a retakaful provider to cover part of the risk)

- Co-takaful outwards (contributions shared with other takaful operators when they jointly cover a risk)

Now, let’s take a look at an example of how surplus sharing is calculated based on the following formula:

As the name suggests, surplus is not guaranteed. It depends on whether there is any excess amount remaining in the takaful fund after deducting expenses and adding investment profits.

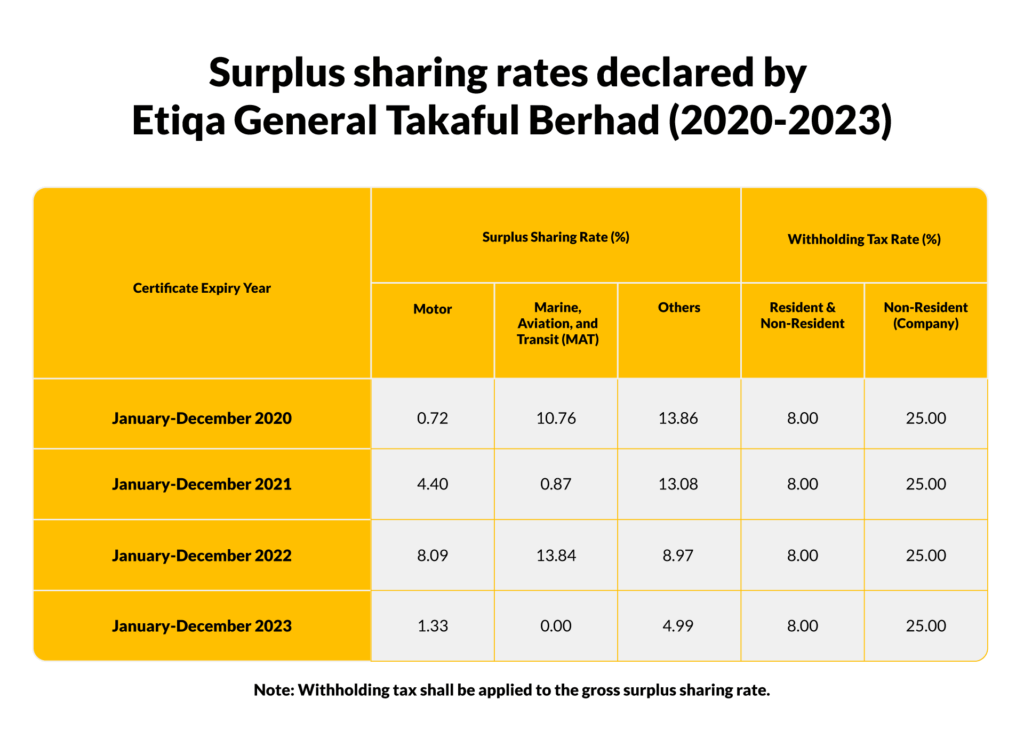

Surplus sharing rates declared by Etiqa General Takaful Berhad

Here’s a look at the surplus sharing rates for Etiqa motor takaful and other takaful products from 2020 to 2023:

FAQs about surplus sharing

Q: Who is eligible to receive surplus?

A: You are eligible if:

- Your takaful certificate is active for at least one year,

- Your certificate is fully paid within the coverage period,

- Your certificate remains active throughout the coverage period, and

- You did not make any claims during the coverage period (except for windscreen, Knock-for-Knock (KFK), or accessories claims).

Q: Will I get a surplus if I make a claim?

A: No, you will not receive a surplus. Surplus sharing only applies to participants who did not make any claims during their coverage period, except for windscreen, Knock-for-Knock (KFK), or accessories claims.

Q: Can I get a surplus if I cancel my takaful certificate early?

A: No. Certificates cancelled prior to the expiry date shall not qualify for surplus distribution.

Q: I did not receive my surplus for my takaful certificate. Why is this so?

A: You might not receive a surplus for several reasons, including:

- The certificate coverage is less than one year

- The certificate was cancelled before its expiry date

- No surplus was declared for that year

- A claim (other than a windscreen, Knock-for-Knock (KFK), or accessories claim) was made during the takaful period

Q: Do I need to apply to get a surplus?

A: No. If you’re eligible, your takaful operator will process it automatically.

Q. When will I get my surplus payment?

A: Your surplus, if any, will be paid to you after the end of the financial year following the expiry of your takaful certificate.

Q: How is surplus payment usually made?

A: Surplus will be credited directly to your registered bank account.

Q: How will Etiqa General Takaful Berhad pay the surplus?

A: Your surplus will be credited directly to your savings or current account. If you’re unsure whether you provided your bank account details when you signed up for your takaful plan, please contact Etiqa at 1300 13 8888.

Q: How do I know if I received a surplus?

A: You’ll receive an SMS notification from your takaful operator if you’re eligible.

Q: I have made an endorsement (a change or amendment to an existing takaful certificate), which resulted in an additional contribution. Will this be considered for surplus sharing?

A: Yes. Your additional contribution from an endorsement (such as adding special perils/extreme weather coverage to your plan) will be part of the annual contribution used to determine the surplus.

Q: I have made an endorsement (a change or amendment to an existing takaful certificate), and this has resulted in the refund of some contribution paid. How would this affect my surplus?

A: The reduction of contribution from an endorsement (such as changing your vehicle coverage from commercial use to private use) will reduce the annual contribution used to calculate the surplus distribution.

Q: Is surplus taxed in Malaysia?

A: The surplus itself is not directly taxed. However, the investment income component of the surplus distributed to individual participants is subject to withholding tax.

Q: What is withholding tax?

A: Withholding tax is applied to income distributed to participants and is only applicable to individual participants. The amount withheld will be paid to Lembaga Hasil Dalam Negeri (LHDN) directly by your takaful operator. This is based on Income Tax Act 1967 S109E (1) to (7).

Q: Is surplus sharing a refund?

A: No. It is a distribution of surplus from the takaful fund’s excess, not a refund of your contribution.

The information contained in this blog is provided for informational purposes only. It should not be construed as advice on any matter. Etiqa accepts no responsibility for loss which may arise from reliance on information contained in this article. This information is correct as of 17 September 2025.