Windscreen Coverage (All You Need to Know!)

Owning a car means taking care of a few important things. You need to keep it in good shape, ensure it’s covered, and have some money saved for unexpected repairs. Something as small as a pebble hitting your windscreen can lead to costly repairs, sometimes running in the thousands of ringgit! If this happens to you (we hope it never does!), does your car insurance or takaful cover your windscreen? Stay with us to find out and learn more about windscreen coverage.

Read More:

- 5 Add-Ons to Improve Your Motor Coverage Plan

- A Tree Fell on My Car: Can I Make an Insurance or Takaful Claim?

- Car Insurance Claims for Accidents (Your Ultimate Guide)

What is windscreen coverage?

Windscreen coverage is an optional benefit that covers the costs of repairing or replacing your windscreen in case of damage. You can add this benefit only to comprehensive or first party car coverage, with an additional premium or contribution. This means that car owners with third party, fire and theft or third party coverage are not eligible for this benefit.

If you have windscreen coverage added to your Etiqa car takaful or insurance, Etiqa will pay for the repair or replacement costs of your windscreen, so you’re not burdened by these expenses.

Does comprehensive coverage cover windscreen damage?

Comprehensive coverage does cover windscreen damage. But, if you don’t add windscreen coverage to your policy or certificate, you will unfortunately lose all your No Claim Discount (NCD) when you make a windscreen claim. This will reset your NCD to zero and cause your premium or contribution to soar. Imagine that your NCD is now at its maximum rate of 55%, a windscreen claim will make your premium or contribution significantly higher the next time you renew your car insurance or takaful.

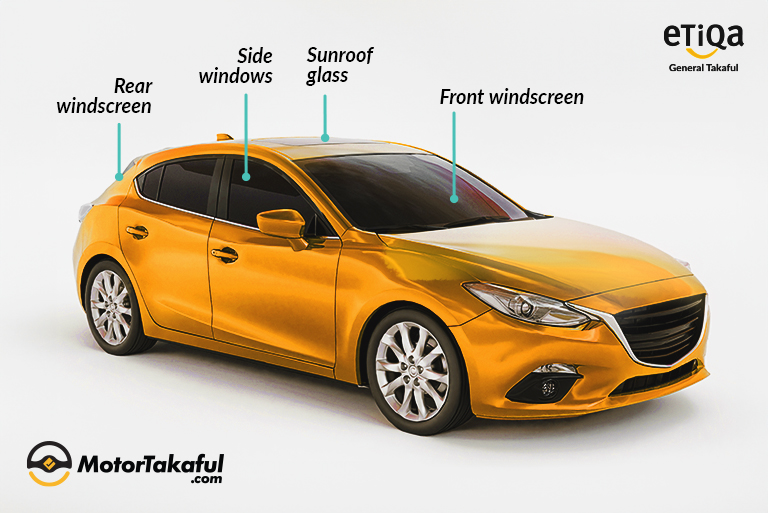

Does windscreen coverage cover all windows?

Yes. Windscreen coverage covers all your car windows:

- Front windscreen

- Rear windscreen

- Side windows

- Sunroof

- Lamination or tinting film (applicable if your windscreen was fitted with tinted film at the time of damage)

With this add-on, Etiqa will also take care of the labour and installation costs so you won’t have to worry about it.

How much does windscreen coverage cost?

Windscreen coverage will only cost you 15% of your windscreen’s price. Assuming that you drive a Perodua Myvi Advanced (2022) with its windscreen costing RM1,000, you would need just RM150 to secure this add-on. If you do the calculation, this means that you will be able to get your damaged windscreen replaced at a whopping 85% off!

If you own a high-end car, your contribution would still be only 15% of your windscreen’s price. You can check out the price of your car windscreen online! (Fun fact: Do you know that a Lamborghini Murciélago’s windscreen can cost as much as RM50,000? That’s enough to buy the latest Perodua Myvi 1.3 G!).

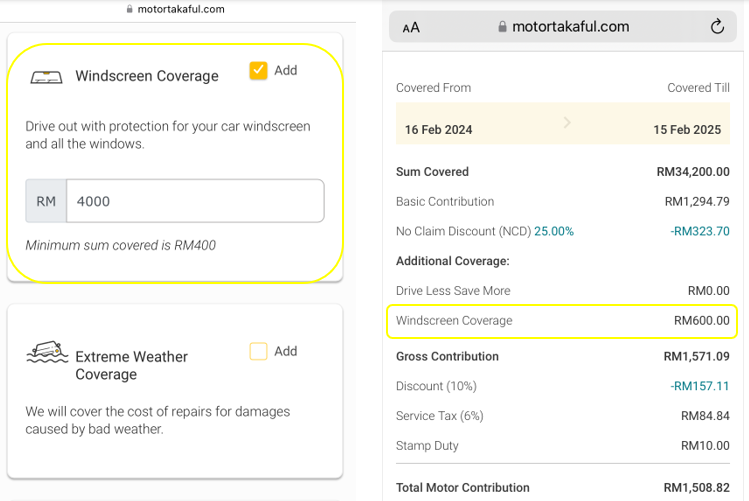

How do I add windscreen coverage to my insurance or takaful?

Adding windscreen cover to your car insurance or takaful is easy, especially with MotorTakaful.com. You can do it online in just a few minutes:

- Step 1: Head on over to MotorTakaful.com and click ‘Renew Now’

- Step 2: Enter your vehicle number, postcode and NRIC

- Step 3: Fill in the required details

- Step 4: In the ‘Additional Coverage’ section, choose ‘Windscreen Coverage,’ and then enter the sum covered for your windscreen based on your windscreen’s price (you may check your windscreen’s price here)

- Step 5: Proceed with payment/contribution, and your car, including its windscreen, is now covered!

How to claim windscreen coverage

You can easily make a windscreen claim in two steps:

- Step 1: Take your car to your insurance or takaful operator’s panel windscreen specialist or panel workshop

- Step 2: Liaise with the windscreen specialist or workshop personnel to provide the required documents to your insurer or takaful operator, and wait for them to fix or replace your windscreen

What documents do you need for an Etiqa windscreen claim?

Get these documents ready to make your windscreen claim:

- Completed motor claim form

- Car insurance policy/takaful certificate or cover note

- NRIC of the policyholder/takaful participant, and business registration forms (Form 9, 24 and 49) if it’s a company-registered car

- Driving licence of the policyholder/takaful participant

- Vehicle registration card/vehicle ownership certificate

As an Etiqa customer, you can hop on to our website to easily locate your nearest panel windscreen specialist or repairer that provides windscreen replacement or repair services.

Does a windscreen claim affect your NCD?

With windscreen coverage, you get to keep your NCD even after you make a claim. So if your current NCD is 55%, you will continue to enjoy the discount after a windscreen claim.

How many times can you claim for windscreen damage?

The number of times you can make a windscreen claim depends on whether your windscreen is replaced or repaired:

Windscreen replacement

This can only be done once during your one-year coverage period. Your windscreen coverage ends as soon as your windscreen is replaced.

Windscreen repair

If your car windscreen is repaired instead, you can continue to enjoy any remaining coverage amount for the rest of the coverage period. For example, if your windscreen’s sum covered is RM1,000 and the repair costs RM800, the RM200 balance can be used for any more windscreen fixes in the same coverage period.

Can you reinstate windscreen coverage after having your windscreen replaced or repaired?

Yes, you can! As an Etiqa customer, you may contact Etiqa Claims Careline at 1-300-88-1007 to help you reinstate your windscreen cover with an additional contribution.

Is it worth getting windscreen cover?

It’s a good idea to get this add-on, especially if your windscreen costs a fortune. By contributing just 15% of what your windscreen costs, you can be covered for fixing or replacing it. Why not go to MotorTakaful.com and add windscreen coverage when you renew your car takaful? Plus, you’ll get a guaranteed 10% discount when you renew with us online!

The information contained in this blog is provided for informational purposes only. It should not be construed as advice on any matter. Etiqa accepts no responsibility for loss which may arise from reliance on information contained in the article. This information is correct as of 5th January 2024.